Risk is a necessary part of growth, although risk management is often overlooked by small business owners. Strategic risk management is just as critical for a start-up, small or growing business as it is for a large, established one.

Risk is an inherent part of being in business. It can be managed and its adverse outcomes can be mitigated. Trying to completely eliminate risk from your business is unrealistic. Risk management helps you overcome unforeseen challenges and situations that may rise up again your business in future.

What is Risk Management?

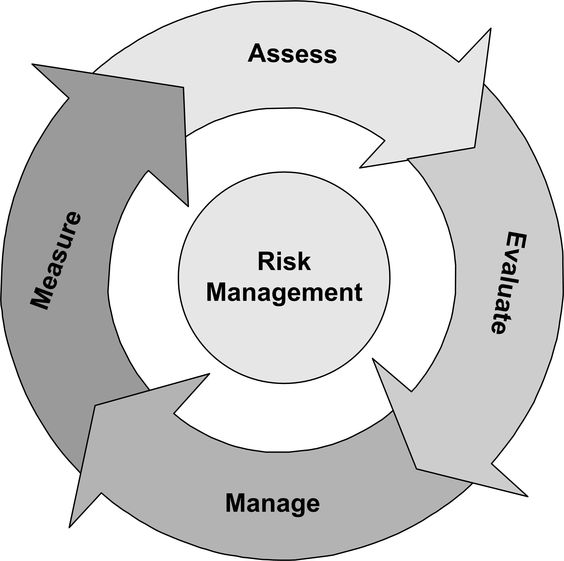

Risk management is a process in which businesses identify, assess and treat risks that could potentially affect their business operations.

Proper risk management implies control of possible future events and is proactive rather than reactive. Proper risk management will reduce not only the likelihood of an event occurring but also the magnitude of its impact.

When you’re planning to get your new business off the ground, it’s important to understand that every business venture, regardless of economic climate, market conditions, products, personnel, and capitalization has risks involved. Once you have identified and assess those risks, you can begin taking steps to reduce them using some of the risk management techniques shared in this post.

As seen in the diagram below, the major purpose of risk management is to access, evaluate, manage and measure the risks.

Also Read: From the Experts – Tips on Getting Your New Business Off the Ground.

What are the common risks for small businesses?

Businesses face all kinds of risks, some of which can cause serious loss of profits or even bankruptcy. Here are the most common types of risks that a small business is much likely to face.

1. Financial Risk.

Direct financial risks have to do with how your business handles money. That is, which customers do you extend credit to and for how long? What is your debt load? Do most of your income come from one or two clients who might not be able to pay? Financial risks also take into account interest rates and if you do international business, foreign exchange rates.

2. Operational Risks.

Operational risks result from internal failures. That is, your business’s internal processes, people or systems fail unexpectedly. Therefore, unlike a strategic risk or a financial risk, there is no return on operational risks. Operational risks can also result from unforeseen external events such as transportation systems breaking down, or a supplier failing to deliver goods.

3. Strategic Risk.

Strategic risks result directly from operating within a specific industry at a specific time. So shifts in consumer preferences or emerging technologies that make your product-line obsolete – eight-track, anyone? – or other drastic market forces can put your company in danger. To counteract strategic risks, you’ll need to put measures in place to constantly solicit feedback so changes will be detected early.

4. Reputational Risk.

No matter which industry you’re in, your reputation is everything. If your reputation as a business is damaged, you’ll see an immediate loss of revenue, as customers become wary of doing business with you. But there are other effects, too. Your employees may get demoralized and even decide to leave. You may find it hard to hire good replacements, as potential candidates have heard about your bad reputation and don’t want to join your firm.

5. Compliance Risk.

Risks associated with compliance are those subject to the legislative or bureaucratic rule and regulations, or those associated with best practices for investment purposes. These can include employee protection regulations or environmental concerns or even state and local agencies.

Also Read: Common small business challenges and how to overcome them.

How to better manage risks in business.

The biggest risk is not taking any risk. Everything has a level of risk, from learning to ride a bicycle to try a new hairstyle. When you own a small business, you know you’re accepting risks, some you’re aware of, and some will be surprises.

1. Transfer the risk.

Buying insurance allows you to transfer your risk to insurance companies. Insuring yourself against the risk of fire is an obvious example the insurer carries the financial risk if a fire destroys your warehouse. Other forms of insurance might include: Life Insurance, Disability Insurance, Professional Insurance, Completed Operational Insurance.

2. Prevent the risk.

The best risk insurance is prevention. Preventing the many risks from occurring in your business is best achieved by changing your business process, equipment or material to achieve a similar outcome but with less risk. In drastic circumstances, if the risk consequences are too high, you could avoid them completely by canceling or stopping the high-risk business initiative.

3.Reduce the risk.

If a risk can’t be avoided reduce its likelihood and consequence. This could include staff training, documenting procedures and policies, complying with legislation, maintaining equipment, practicing emergency procedures, keeping records safely secured and contingency planning.

4. Accept the risk.

Accepting the consequences of the risk may be your only option when all other options have been exhausted. This is often accomplished by developing a contingency plan to execute should the risk event occur. This strategy works best for small risks where the impact isn’t that big, or for risks that are unlikely to happen.

Also Read: 4 Important Metrics To Track For Business Growth In 2018.

Conclusion

There will always be risk involved with starting a business or doing something new with your business. Conducting a risk management assessment is just one way to know what those risks are. That way, you can create a plan for managing them to ensure they have as little impact on your business as possible.

Follow us on Twitter or visit our Facebook page for more resources to grow your business online.